Bitcoin Tops $67K as Cryptos Rally In the midst of Worldwide IT Blackout; Solana’s SOL Leads Altcoins

Friday’s crypto rally challenged past days’ correlation with U.S values, which proceeded with their losing streaks.

The crypto rally continued on Friday with bitcoin (BTC) scoring its highest prices in a month, while the world wrestled with a significant IT blackout.

BTC began rising from $64,000 during the early U.S. trading hours and broke above $67,000 later in the day interestingly since June 17. The price increment was accompanied areas of strength for by volumes for BlackRock’s spot bitcoin ETF (IBIT). At press time, the biggest crypto asset changed hands somewhat above $67,000 progressing 5.5% throughout last 24 hours.

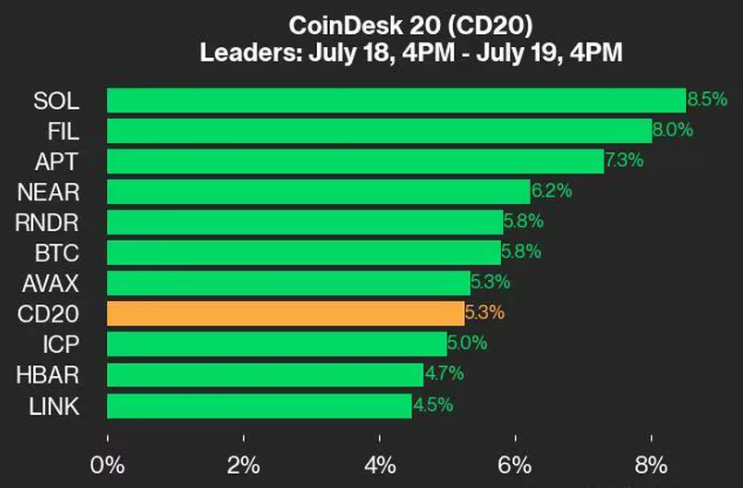

Solana (SOL) drove among altcoin majors with a 8.5% increase over a similar period, beating $170 interestingly since early June. The token beat the wide based Digital Asset benchmark CoinDesk 20 Record (CD20), which rose 4.3%.

- Bitcoin hit a one-month exorbitant cost, flooding 5.5% throughout the course of recent hours.

- Solana rose 8%, beating $170 interestingly since early June.

- Crypto observers highlights the versatility of decentralized blockchains as a failing programming update caused global disturbances in IT systems.

The crypto rally continued on Friday with bitcoin (BTC) scoring its highest prices in a month, while the world wrestled with a significant IT blackout.

BTC began rising from $64,000 during the early U.S. trading hours and broke above $67,000 later in the day interestingly since June 17. The price increment was accompanied areas of strength for by volumes for BlackRock’s spot bitcoin ETF (IBIT). At press time, the biggest crypto asset changed hands somewhat above $67,000 progressing 5.5% throughout last 24 hours.

Solana (SOL) drove among altcoin majors with a 8.5% increase over a similar period, beating $170 interestingly since early June. The token beat the wide based Digital Asset benchmark CoinDesk 20 Record (CD20), which rose 4.3%.

Ethereum’s ether (ETH) recovered the $3,500 level, however failed to meet expectations with a 3% expansion. The first spot-based ETH Exchange-traded-funds (ETF) in the U.S. will probably begin exchanging on Tuesday one week from now, Friday regulatory filings by Cboe showed.

Cryptocurrencies slid lower recently couple with a U.S. stock auction. Nonetheless, Friday’s meeting occurred as major equity indexes proceeded with their losing streaks.

The tech heavy Nasdaq Composite was down 0.8%, while the wide based S&P 500 lost 0.6% starting around 1 p.m. ET, while gold dove more than 2% during the day following a new all-time recently.

As a software update by cybersecurity specialist organization CrowdStrike caused far reaching PC blackouts all over the world halting airlines, banks and organizations, some crypto spectators stressed the flexibility of decentralized frameworks like public blockchains compared with centralized networks.

Bitcoin targets $100,000 by year-end :

Looking at a longer timeframe, bitcoin is trading around the midpoint of a multi-month sideways channel somewhere in the range of $56,000 and $73,000. Spot prices may be range-bound in the close to term, however traders are progressively situating for a breakout to new all-time highs towards the U.S. elections in November, digital assets mutual funds QCP said in a market update. QCP analyzers noted solid demand for December $100,000 bitcoin call choices from establishments.

Mads Eberhardt, crypto analyzer at Steno Research center, communicated a bullish view for the final part of the year for crypto resources, upheld by different tailwinds including coming U.S. interest rate cuts, rising liquidity, regulatory clarity in Europe and rising possibilities of more crypto-accommodating U.S. initiative.

“Bitcoin at $100,000. Ethereum at $6,500,” he said about his price targets.

#Keep Connected to Credbazar.com

Disclaimer: Cred Bazar gives crypto market news for informational purpose only and should not be interpreted as investment guidance. Readers are urged to talk with a expert financial consultant prior to making any investments.

Leave a Reply